In today’s world, microfinance has become an essential tool for empowering underserved communities, providing them with access to financial services that fuel entrepreneurship and economic growth. However, despite its potential, microfinance institutions still face significant challenges in scaling their operations and reaching a broader audience.

At Paradiso Solutions, we believe that AI in microfinance can transform this sector, helping institutions overcome operational barriers and unlocking new possibilities for financial inclusion. Our innovative solutions are designed to streamline processes, reduce costs, and improve the overall customer experience. Here’s how our AI-powered microfinance platform is reshaping the future of microfinance.

The Current Challenges in Microfinance

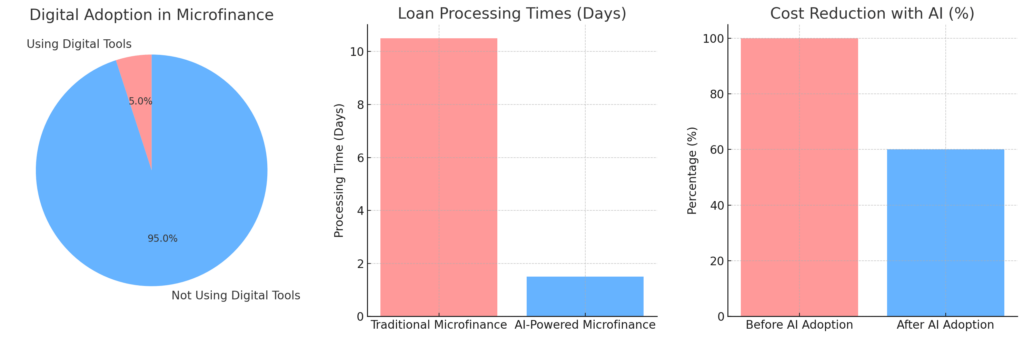

Microfinance institutions operate in a highly demanding environment. The loans they provide are often small and time-sensitive, yet the application process is frequently bogged down by inefficiencies. Digital adoption remains shockingly low, with only 3-5% of customers utilizing digital transformation in microfinance services. This is primarily due to several persistent challenges:

- Local language support is often lacking, limiting access for those unfamiliar with major languages.

- Loan processing times are prolonged, with manual document verification slowing down decision-making.

- High operational costs reduce scalability, making it harder for institutions to grow and serve more customers.

The demand for microfinance solutions that address these challenges is clear, and AI microfinance platforms are proving to be the key to overcoming these obstacles.

Statistics and Facts: The State of Microfinance

Globally, microfinance has had a substantial impact on financial inclusion, particularly in regions where traditional banking services are limited. Yet, despite these successes, operational inefficiencies continue to hamper growth:

- Microfinance institutions still struggle with processing large volumes of small loans efficiently.

- Unbanked populations in key regions, such as Africa and South Asia, remain underserved, with limited access to microfinance technology.

- On average, the time it takes to process microfinance loans can be significantly longer than in other financial sectors, impacting customer satisfaction and institutional efficiency.

- Digital adoption rates in microfinance are well below other financial services, primarily due to the lack of local language support and easy-to-use platforms.

These statistics highlight the urgency of adopting AI-driven microfinance innovation to address the industry’s most pressing issues.

AI in Microfinance: A Game-Changing Solution

At Paradiso Software, we understand that AI in financial services is a game-changer for microfinance institutions. Our AI microfinance platform is designed to streamline loan processing, reduce costs, and enhance the customer experience—all while maintaining the high level of accuracy and trust needed in financial operations.

AI-powered loan processing brings unprecedented speed and efficiency to the sector. By automating document verification, loan approval workflows, and risk categorization, institutions can now handle more loan applications in less time. This doesn’t just improve productivity; it transforms how institutions operate.

Key Features of the Paradiso AI Microfinance Platform

Our platform offers a comprehensive suite of microfinance solutions, designed to address the unique needs of financial institutions. Some of the key features include:

AI-Powered Mobile App

The AI-powered mobile app is a cornerstone of our solution, designed to enhance customer accessibility and simplify the loan application process. The app includes:

Local language support

Ensuring that users from diverse backgrounds can access the services without language barriers.

Voice-enabled features

to guide users through the application process, making it intuitive and accessible even for those less familiar with technology.

A user-friendly interface

that allows customers to apply for loans and track their applications with ease.

AI Co-Pilot for Loan Processing

Loan processing is often one of the most time-consuming tasks for microfinance institutions. With the AI co-pilot, this process becomes faster and more efficient. Key features include:

Automated loan approval:

AI can review applications, verify documents, and provide risk categorization into high, medium, or low-risk categories.

Real-time notifications:

Customers are kept informed about their application status, building trust and improving customer satisfaction.

AI and risk categorization:

Institutions can focus their resources more effectively by prioritizing high-risk applications while automating lower-risk ones.

Comprehensive AI Platform Features

Our AI microfinance platform goes beyond basic automation, offering a full suite of tools for financial institutions:

- The creation of custom documents, multimedia content, and translations, making the process more flexible and accessible.

- Automation of approval workflows, emails, and communication channels, helping institutions maintain efficiency and reduce operational burdens.

- AI-driven analysis of loan contracts and applications to enable data-driven decision-making.

The Benefits of AI for Microfinance Institutions

The integration of AI in microfinance offers substantial benefits, not only for institutions but also for their customers:

-

Increased productivity:

By automating labor-intensive tasks, institutions can handle more applications in less time, boosting overall efficiency. -

Cost reduction in microfinance:

Automation reduces operational costs, allowing microfinance institutions to remain competitive and grow sustainably. -

Improved customer satisfaction:

Institutions can focus their resources more effectively by prioritizing high-risk applications while automating lower-risk ones. -

Scalability:

With AI-powered loan processing, institutions can expand their operations without needing to proportionately increase their resources, allowing them to serve more customers at a lower cost.

Looking Ahead: The Future of AI in Microfinance

The future of AI in financial services, especially in the microfinance sector, is incredibly promising. By continuing to innovate, Paradiso Solutions is committed to driving AI-driven microfinance innovation that will allow institutions to meet the evolving needs of their customers while improving efficiency and reducing costs.

The application of AI is just the beginning. As AI in mobile banking and microfinance continues to evolve, we envision a future where AI microfinance platforms will lead to greater financial inclusion, helping underserved communities access the resources they need to thrive.

Conclusion

The integration of AI in microfinance is set to revolutionize how institutions operate, providing them with the tools they need to overcome challenges and scale efficiently. At Paradiso Solutions, we believe that technology is the key to unlocking a future of financial inclusion for all, and our AI-powered microfinance platform is paving the way for that future.

By embracing AI, microfinance institutions can not only streamline their operations but also create a more inclusive financial ecosystem, reaching more customers and providing better services than ever before.